American households saved nearly $2.1 trillion during the early stages of the pandemic, helping buoy them against record inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

and pandemic-related economic uncertainty. Now this “excess savings” is dissipated and the role of public policy to encourage greater savings is more salient. Given the complex system of incentives currently in place, policymakers should focus on reforms to ensure taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy does not stand in the way of household savings.

Thankfully, Americans have role models in Canada and across the Atlantic in the United Kingdom (UK) to learn from. The UK has a strong track record of providing households with a broad, simple vehicle for savings—the individual savings account (ISA).

Individual savings accounts began as personal equity plans (PEPs) in 1986, which were intended to broaden investment opportunities for savers in the UK. The PEPs originally allowed for contributions up to £2,400 annually. In 1999, the PEPs were replaced by ISAs, and the maximum annual contribution was increased several times to £20,000 (about $25,000) annually in 2024. ISAs supplement the UK’s retirement savings system, which includes pensions that operate like U.S. traditional 401(k) plans.

Like tax free savings accounts (TFSAs) in Canada, the UK’s ISAs are Roth-style tax advantaged savings accounts where contributions are made with after-tax dollars and earnings grow tax free. There are no taxes, penalties, or restrictions on withdrawals, making ISAs a simple way for households to save for a variety of future financial goals. Also, like Canada’s TFSAs, but unlike Roth individual retirement accounts (IRAs) in the U.S., there are no income limits for ISA eligibility.

In addition to saving in ISAs, households in the UK may contribute up to £9,000 annually in a Junior ISA for their children and adults aged between 18 and 50 can contribute another £4,000 in a lifetime ISA, a program that began in 2017 to encourage saving for a home or to supplement retirement savings.

Individual savings accounts have grown in popularity over time. In 1999, about £28.4 billion were invested in ISAs across 9.3 million people. By 2021, nearly £67 billion was invested across 11.8 million people within adult ISAs.

More than 22 million people in the U.K. hold some type of ISA—equating to roughly 40 percent of the eligible adult population representing households across the income spectrum. A larger portion of UK households contribute to ISAs than Americans who contribute to Roth IRAs.

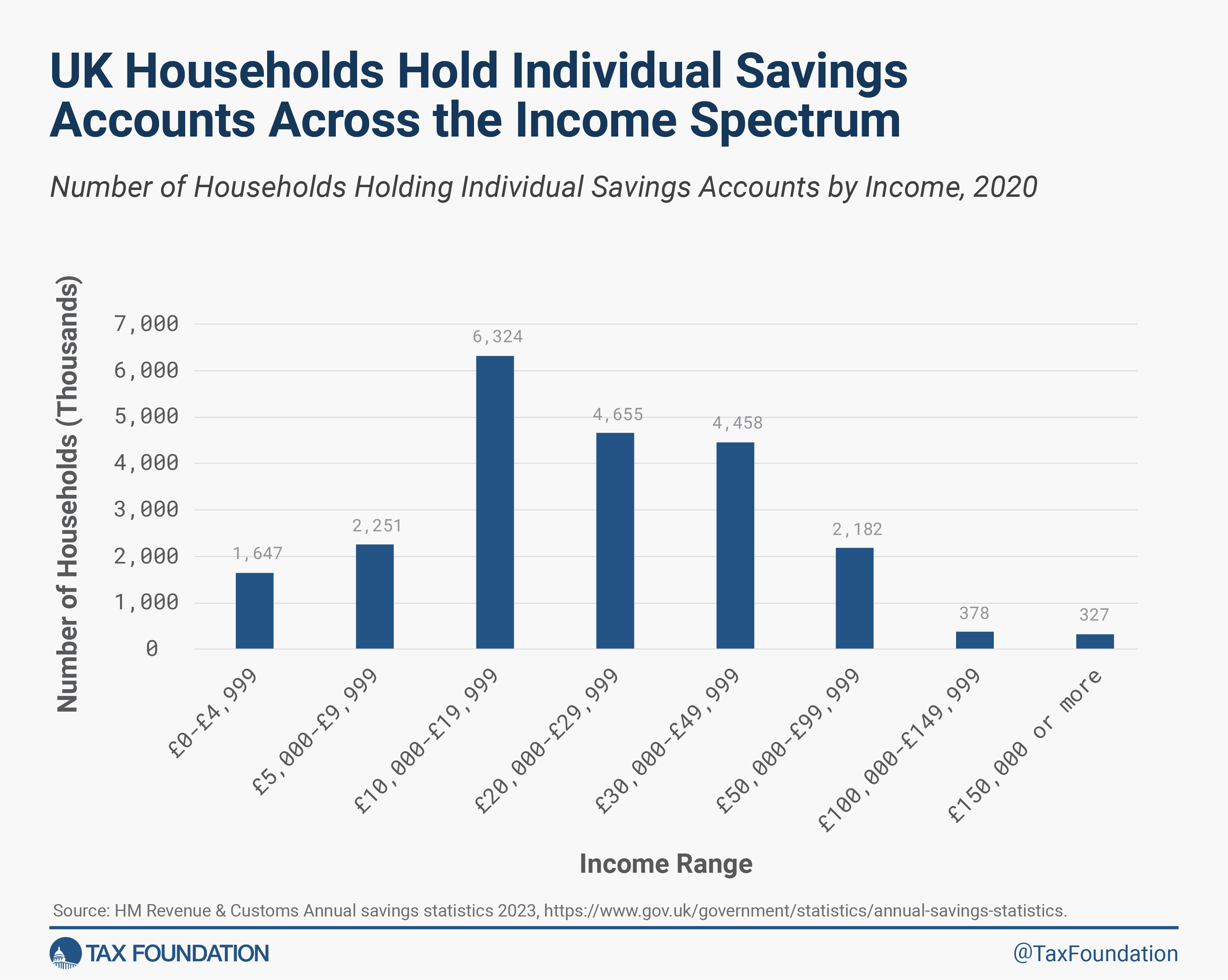

As with Canada’s TFSAs, many low- and moderate-income households in the UK make substantial use of ISAs. More than 10 million households, about 46 percent of households contributing to any type of ISA, earn under £20,000 (about $25,000) per year (see Figure 1). More than 19 million households, about 87 percent of ISA holders earn, less than £50,000 (about $62,675) annually.

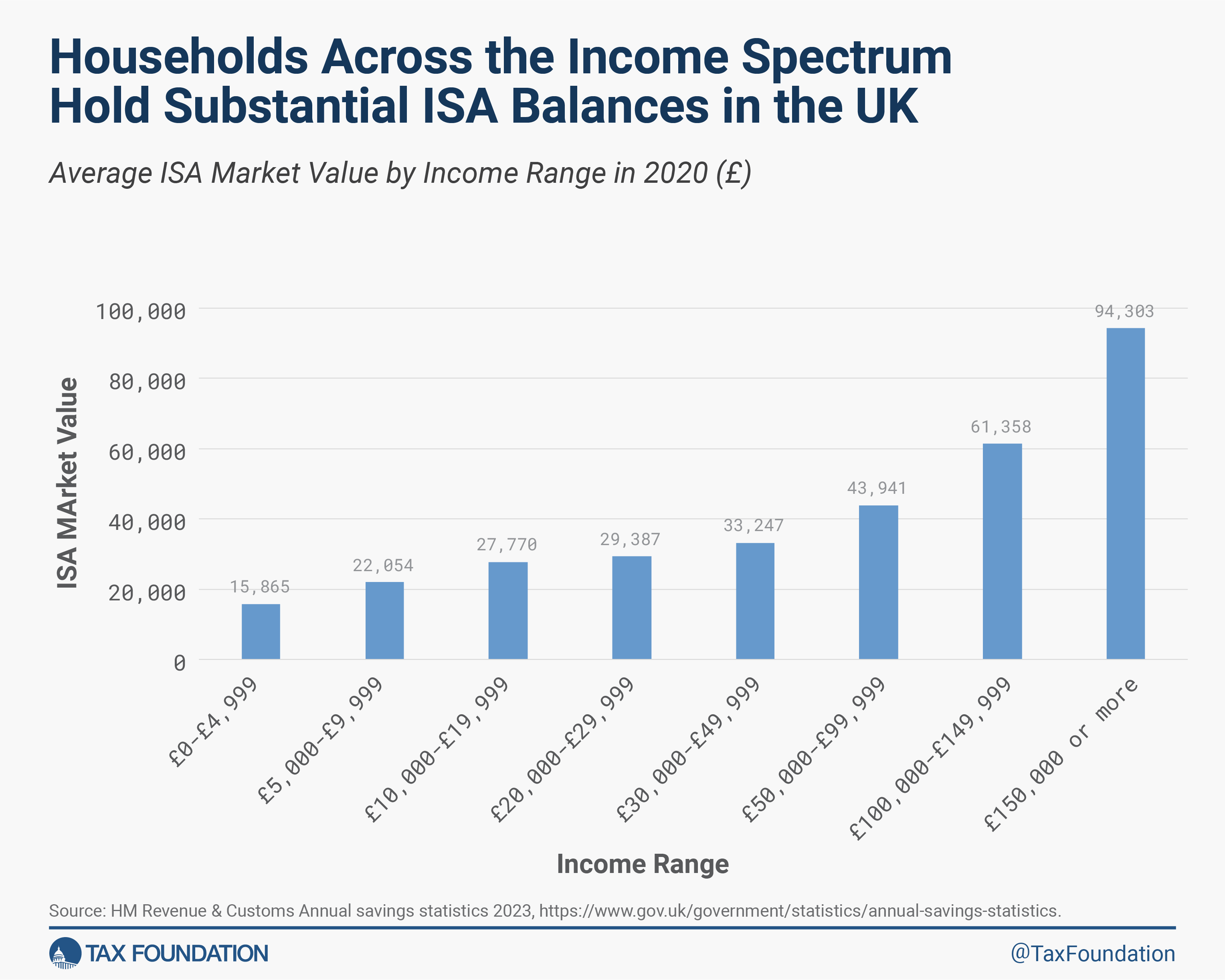

The market value of ISA holdings also show that the program has attracted savings from households across the income spectrum. The average market value of ISA accounts was £30,885 in 2020 (see Table 1 and Figure 2 below). Households earning less than £5,000 with an ISA held about £15,865 on average, more than triple their income. Those earning between £5,000 and £10,000 with an ISA held about £22,054 on average, more than double their income. As income rises, so does the value of ISA holdings but less than proportionately. Those earning £150,000 or more held an average ISA market value of £94,303. Most households with an ISA, about 53 percent, held at least £5,000 in their account.

It is clear why individual savings accounts are popular in the UK: they are a simple, liquid savings option for households, functioning like a regular savings or investment account but without any tax on the returns and no restrictions on the use of funds. This is attractive and useful to millions of UK households at different income levels, life stages, and with different financial goals.

While ISAs are popular and superior to the available options in the U.S., the distinction between adult and junior ISAs can cause confusion and the strict cap on annual contributions limits how much savings can benefit from the program. This may explain why Canada’s more straightforward TFSAs are even more widely used and have been adopted at a faster rate since becoming available in 2009.

For U.S. policymakers looking to encourage greater saving and financial security, particularly among low- and moderate-income households facing serious affordability challenges, the experiences in both the UK and Canada indicate that universal savings accounts are an effective policy tool to help reach that goal.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share