French President Emmanuel Macron promised to rein in the country’s budget deficit within the next four years. Newly released data shows France is moving in the wrong direction.

On 26 March, the French National Institute of Statistics and Economic Studies (INSEE) found that France’s 2023 budget deficit was a surprising 5.5 percent of GDP—0.6 percent over the government’s 4.9 percent target. The €154 billion gap puts into doubt President Macron’s goal of cutting France’s deficit to less than 3 percent of GDP—in line with the EU’s Stability & Growth Pact rules—by 2027.

Fundamentally, French society is engaged in a debate about the promises of economic growth, the quality of public spending, and overall fiscal fairness. Many are wondering what role growth and taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy should play in stabilizing public finances over the long term.

This is not to mention the public protests, such as the Yellow Vests, that have made it clear to all political parties that tax policy’s effects on their standard of living is a critical issue. Partners interested in joint economic reforms at the EU level, including joint debt proposals to finance a more geopolitically ambitious agenda, are also watching with a skeptical eye.

Overall, France’s problem is not the lack of profitable economic activity to tax; it’s the tax system’s inefficiency. To make systematic and competitive reforms, policymakers should focus on principled tax policy.

Reform Proposals So Far

Finance Minister Bruno Le Maire has called for cuts to public spending to reduce the budget gap and has ruled out increasing taxes. The latter is consistent with President Macron’s position since he was elected in 2017 to restore competitiveness, grow the French economy, and increase revenue. After all, France already has one of the highest combined tax and mandatory contribution rates in the world and an above-average 110.6 percent debt-to-GDP ratio.

However, opponents have suggested that increased growth and cuts to current public spending will not generate enough revenue to stabilize public finances after taking into account rising interest rates, public investment for the green transition, and increased defense costs. Therefore, they argue that tax increases must be part of the long-term solution.

But French tax reform is more complicated than whether the rich should pay more or the poor should pay their own way. Proposing policies that sound good politically but don’t solve the problem—like extending temporary windfall profits taxes on energy companies—fail to raise sufficient revenue and further erode public trust in policymakers to find meaningful solutions.

Growth Matters for Revenue

Reducing public spending is one way to close the budget deficit in the short term. However, given that the total rate of tax and social contributions in France is close to 50 percent of economic production, policymakers should avoid cutting public spending too rapidly because it can reduce long-term economic growth. For every one percent of GDP lost, a 0.5 percentage point increase in the deficit can be expected.

Equally important for growth is to understand that there is a hierarchy of better and worse ways to raise a euro of revenue because different types of taxes impact the economy in different magnitudes.

For example, taxes on the most mobile factors in the economy, such as capital, cause the most distortions and have the most negative impact. Taxes on factors that can’t easily be moved, such as land, are the most stable and least distortive. Furthermore, consumption taxes, such as the value-added tax (VAT), are relatively neutral, minimally distortive, and a more economically efficient way to raise revenue. Understanding the distortive effects of certain tax policies compared to others would allow policymakers to achieve their growth and revenue goals more easily.

Does France Have a Competitive and Neutral Tax System?

In general, a competitive tax system keeps marginal tax rates low due to the mobility of capital while a neutral system aims to raise the most revenue with the fewest economic distortions. There are many factors that contribute to a country’s economic performance, but a competitive and neutral tax system promotes sustainable economic growth and investment while raising sufficient revenue for government priorities.

After years of being the least competitive tax system in the Organisation for Economic Co-operation and Development (OECD), France has made its tax system more competitive under President Macron by gradually reducing the statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

rate from 33.3 percent to 25.83 percent, cutting personal income taxes, simplifying contributions to the social security system, and implementing various property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

reforms.

However, too often a competitive tax system is mistaken in the public debate to mean a low corporate tax rate. While the corporate tax rate can sway investment decisions, having a competitive tax system goes well beyond the rate charged on corporate income.

According to Tax Foundation’s 2023 International Tax Competitiveness Index, which seeks to measure the extent to which a country’s tax system is competitive and neutral, France still ranks 36th out of 38 OECD countries. Broadly, this is due to significant complexity throughout the tax system, tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

issues, and economically distortive policies.

For example, France ranks 32nd overall in the OECD on consumption taxes. This is not necessarily due to a high rate (which ranks 16th) but rather to the consumption base’s design (ranked 36th).

Ideally, the VAT should be levied at a standard rate on all final consumption, but French policymakers have implemented rate reductions on some products and exempted certain goods from the VAT base. The C-efficiency ratio (which measures how much of final consumption the VAT covers) is only at 53 percent, revealing both policy and enforcement gaps. The OECD average is 58 percent.

On top of that, France’s VAT threshold (€91.900) is the third-highest in the OECD relative to purchasing power, only behind Italy (€85.000) and the Czech Republic (€79.000) and more than twice the OECD average of around €34.000 (in terms of French purchasing power).

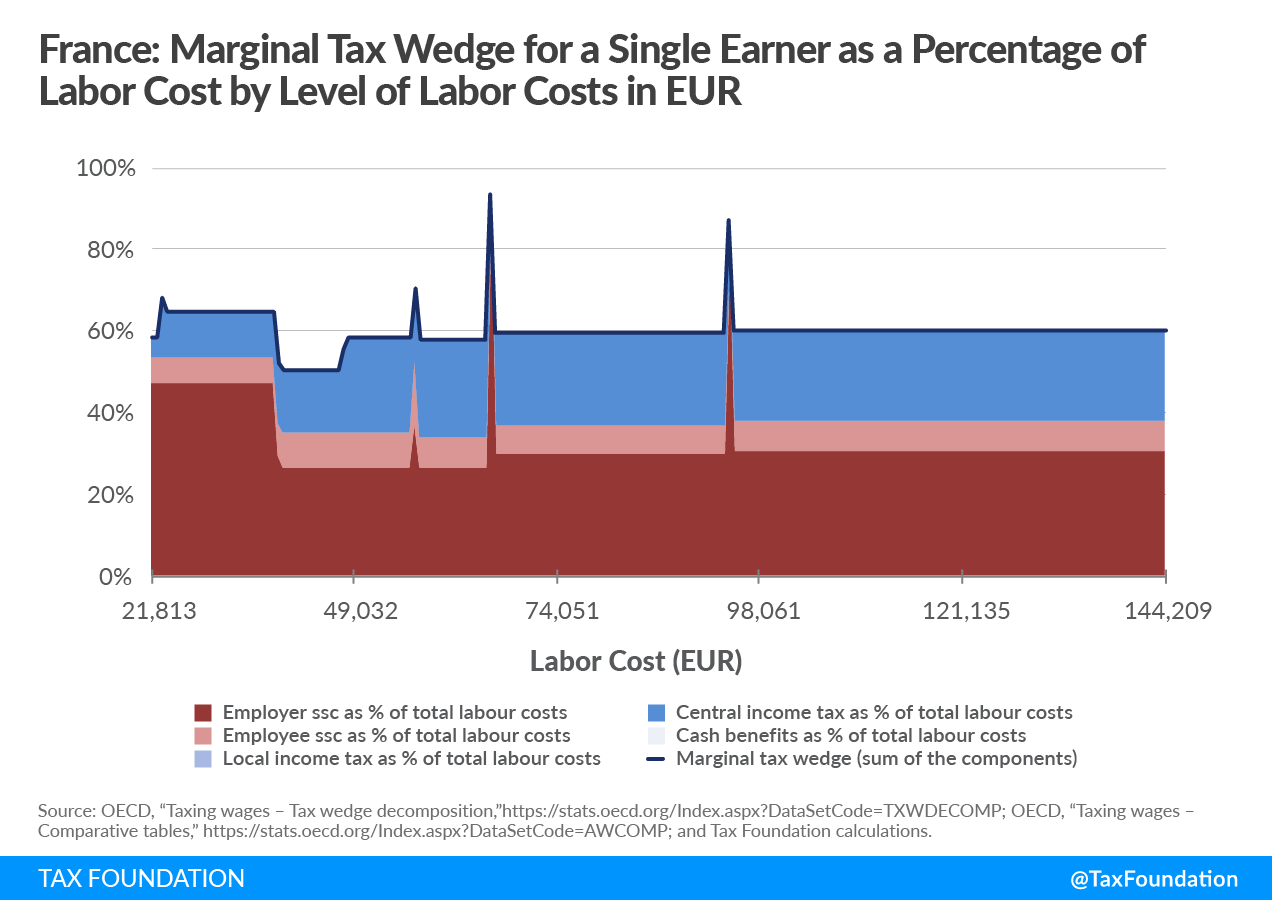

Furthermore, the French income tax structure discourages worker mobility. Given the complexity of the social security contribution system, multiple unintended spikes occur across the marginal tax wedgeA tax wedge is the difference between total labor costs to the employer and the corresponding net take-home pay of the employee. It is also an economic term that refers to the economic inefficiency resulting from taxes.

. This can especially hurt average-income workers that parties across the political spectrum claim to want to help.

Finally, France is one of the last remaining countries in Europe to rely on business turnover taxes. These production taxes—known as the cotisation sur la valeur ajoutée des entreprises (CVAE), cotisation foncière des entreprises (CFE), and cotisation économique territoriale (CET)—are regressive, because they tax income rather than profits, and are disconnected from a business’s economic performance. The government has correctly identified these policies as problematic but has continued to delay their correction. This is in addition to the digital services tax that produces a similar regressive result.

This is far from an exhaustive list of flaws in the French tax system, but these examples help illustrate the broader uncompetitive and non-neutral themes.

Efficiency Reforms

The good news for French policymakers looking to efficiently raise more revenue while maintaining economic growth is that there are lucrative options available.

At €73 billion, France has the largest VAT actionable policy gap in the EU, which is a measure of lost revenue due to policymakers policy choices, such as reduced rates on certain goods or exempting certain items from the VAT base altogether. Because this foregone revenue is due to choices, policymakers can change those choices to a more efficient mix while supporting economic growth.

Furthermore, smoothing marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax.

variation over income levels would likely raise labor supply and encourage the upward mobility of workers. This is especially true for average-income workers. Finally, eliminating regressive production taxes on businesses would increase their competitiveness and growth potential.

In terms of equity, all of these policy changes would help reduce France’s tax burden on labor, which is one of the highest in the OECD at 47 percent.

Rather than pushing unsound tax policy solutions because they are politically convenient, French policymakers should adopt structural tax system reform. Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share