Key Findings

- Taxpayers reported $14.8 trillion of total income on their 2021 taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

returns. - About 61 percent ($9.0 trillion) consisted of wages and salaries, and nearly 80 percent of all tax filers reported earning wage income.

- Retirement accounts, such as 401(k)s and pensions, are important sources of capital income for the middle class, accounting for nearly $1.3 trillion of income in 2021.

- Combined with taxable Social Security benefits of nearly $413 billion, retirement income accounted for nearly $1.7 trillion of income in 2021.

- Business income is another large component of reported personal income. Businesses that report income taxes through the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

system, like S corporations, sole proprietorships, and partnerships, accounted for nearly $1.5 trillion of income in 2021. - Investment income consisting of net capital gains, taxable interest, and ordinary dividends accounted for nearly $2.6 trillion of income in 2021, more than both business income and taxable retirement income, after near record high capital gain realizations in 2021.

- Several categories of income changed significantly from 2020 to 2021 because of the COVID-19 pandemic-related downturn and subsequent economic recovery, including unemployment compensation and capital gains.

Introduction

The individual income tax is the federal government’s largest source of revenue. Taxpayers filed more than 160 million individual income tax returns for tax year 2021, the fourth year under the changes made by the 2017 Tax Cuts and Jobs Act (TCJA).

Each household with taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

must file a return to the Internal Revenue Service (IRS). On the IRS individual income tax form (Form 1040), taxpayers list and add all sources of taxable income to reach total income. From there, taxpayers figure their deductions and credits to determine tax liability and tax owed or refunded.

This report will focus on sources of reported total income on Form 1040, which amounted to nearly $14.8 trillion. Reviewing reported income helps understand the composition of the federal government’s revenue base and how Americans earn their taxable income. We divide income into four major categories—wages and salaries, business income, investment income, and retirement income—and review each category for tax year 2021. It is important to note that tax data comes with some limitations, namely that not all economic activity is found on personal income tax forms. For example, employer-provided health insurance and returns to owner-occupied housing are excluded. Both are substantial components of economic output that do not appear on income tax returns. As broad economic aggregates, though, the categories of income established on Form 1040 are still useful and instructive.

Wages and Salaries Make Up $9.0 Trillion of Personal Income

Wages and salaries comprise the largest overall source of total income. For most tax filers in the U.S., the largest income number on Form 1040 appears on the line where they report wages, salaries, tips, and other compensation for their work. In other words, most Americans report earning labor income, and most of their income comes from labor. In total, more than 126 million tax filers in 2021 reported $9.0 trillion in wage income—61 percent of total income. That compares to $8.4 trillion and 66 percent in 2020.

The amounts reported on Form 1040 reflect most, but not all, labor compensation. For example, employer contributions to Social Security and payments for employee health benefits are both excluded from income taxation.

Wage and salary income is taxed at a progressive rate schedule with rates ranging from 10 percent to 37 percent. The top rate of 37 percent was levied on taxable income above $523,600 for single filers and above $628,300 for married couples filing jointly in tax year 2021.

Business Income Makes Up Nearly $1.5 Trillion of Personal Income

In the U.S., pass-through entities are the dominant tax filing structure for businesses, so labeled because the income is “passed through” to individual owners’ tax returns using schedules C, E, and F, rather than taxed at the business level.

Unlike corporations subject to the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

, pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

income is taxed as ordinary income on owners’ personal tax returns at the same progressive rate schedule as salaries and wages. The TCJA established a temporary 20 percent tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions.

for pass-through business income, notwithstanding certain limits and qualifications.

Pass-through firms employ most of the private-sector workforce in the U.S. and account for most business income. Partnerships and S corporations reported more than $975 billion of net income less losses in 2021. Individuals reported an additional $411 billion of business or professional income less losses (sole proprietorship income). Together, business income less losses totaled about $1.5 trillion when including income from estates, farms, trusts, rents, and royalties, compared to $1.1 trillion in 2020.

Investment Income Makes Up Nearly $2.6 Trillion of Personal Income

Overall taxable investment income, consisting of taxable interest, ordinary dividends, and capital gains income, amounted to $2.6 trillion in 2021, compared to $1.6 trillion in 2020. Taxpayers reported nearly $387 billion of taxable ordinary dividends, $103 billion of taxable interest, and $50 billion of net gains from sales of property other than capital assets, such as certain real business property or copyrights. Capital gains realizations reached a 40-year high in 2021, growing more than 80 percent from to 2020 to exceed $2 trillion.

Taxable labor compensation is much larger than taxable investment income. While the returns to corporate stock and other capital assets found on individual income tax returns are substantial — even reaching a 40-year high in tax year 2021, in aggregate—they remain relatively small compared to the $9.0 trillion of taxable labor income earned in tax year 2021.

Some investment income is subject to ordinary income tax rates, and some is subject to a separate schedule with lower tax rates. Taxable interest, ordinary dividends, and short-term capital gains (gains realized on assets held for less than one year) are taxed as ordinary income at a taxpayer’s marginal income tax rate, just like wage and salary income. Long-term capital gains (gains realized on assets held for more than one year) are taxed at lower rates, ranging from 0 percent to 20 percent, plus a 3.8 percent net investment income tax, depending on a taxpayer’s taxable income. Qualified dividends are also taxed at preferential rates, but the IRS does not include them in total income.

Retirement Income Makes Up Nearly $1.7 Trillion of Personal Income

In 2021, taxpayers reported $858 billion of taxable income from pensions and annuities and $408 billion of taxable Individual Retirement Arrangement (IRA) distributions. In addition to private saving, taxpayers reported nearly $413 billion in taxable Social Security benefits in tax year 2021, for a total $1.7 trillion in taxable retirement income. That compares to about $1.5 trillion in 2020.

America’s system of retirement accounts, while overly complex, is taxed neutrally, removing the income tax’s bias against saving. Many retirement accounts offer tax-deferred status, and distributions from tax-deferred IRAs and withdrawals from pension and annuity accounts are taxed as ordinary income and face a progressive rate schedule with rates ranging from 10 percent to 37 percent. A portion of Social Security benefits may be taxable at ordinary income rates as well, depending on a taxpayer’s total amount of income and benefits for the tax year.

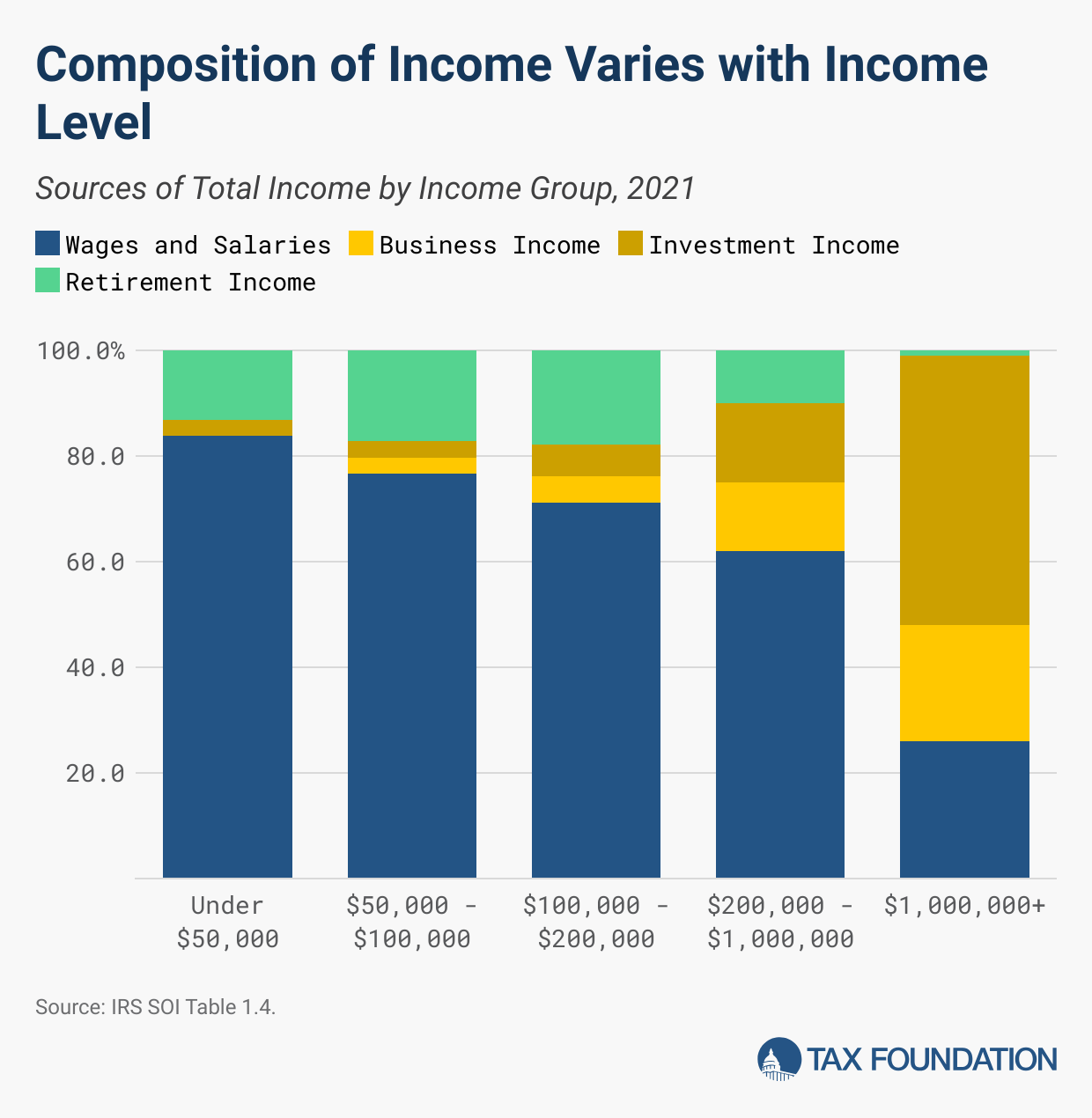

Composition of Income Varies with Income Level

The importance of different sources of income varies by income level. For example, retirement income is most important as a source of income for taxpayers making between $50,000 and $200,000, comprising 17 percent to 18 percent of total income. In practice, of course, a minority of middle-class taxpayers—retirees—rely on retirement income, while the majority of working-age taxpayers do not. Business income and investment income held outside of retirement accounts are most important to higher-income taxpayers, while wages and salaries comprise the largest share of income for lower-income taxpayers.

The Impact of the COVID-19 Pandemic and Economic Recovery

The COVID-19 pandemic had a profound impact on economic stability in the United States, and it can be seen in the 2021 individual income tax return data.

Personal income increased by 17 percent from 2020 to 2021, compared to 5 percent growth from 2019 to 2020, driven largely by capital gains realizations reaching a 40-year record high. The aggregate growth, however, masks different experiences across income groups. For instance, after increasing by 9.9 percent from 2019 to 2020, personal income growth accelerated further for taxpayers making $50,000 and above, reaching 15.8 percent from 2020 to 2021.

By contrast, taxpayers making under $50,000 experienced slight negative personal income growth in 2021(-0.3 percent) after only 1.3 percent growth from 2019 to 2020. Excluding taxpayers reporting a net loss for their income, the contrast becomes starker. Taxpayers making between $1 and $50,000 experienced a 3 percent year-over-year increase in 2020 followed by a 5.2 percent drop in 2021.

This pattern holds for salaries and wages, the largest source of personal income. Taxpayers making $50,000 and more experienced a 9.7 percent increase in 2021, while taxpayers making under $50,000 saw a 3.7 percent decrease in salaries and wages. Compared to year-over-year growth in 2020, gains for the top accelerated from 4 percent and losses for the bottom decelerated from 6 percent.

A large part of total growth in 2021, as well as the higher growth rates in income for higher income taxpayers, was from a significant increase in capital gains realizations after a strong year of stock market performance. From 2019 to 2020, capital gains income rose from $865 billion to $1.1 trillion, a more than 30 percent increase. In 2021, capital gains income experienced more than 80 percent growth, skyrocketing to exceed $2 trillion. Several other categories of income, including gambling earnings, taxable IRA and retirement account distributions, partnership and S corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT).

earnings, and sole proprietorship earnings also increased in 2021.

In addition to a drop in taxable salaries and wages for lower-income taxpayers, unemployment compensation decreased significantly from 2020, though it remained well-above typical levels. From 2019 to 2021, reported unemployment insurance rose dramatically from $21 billion in 2019 to $405 billion in 2020, a more than 1,700 percent increase, due to an expansion of unemployment benefits in 2020 amidst record high unemployment levels. As the economy began recovering and pandemic expansions to unemployment benefits expired, unemployment compensation fell to $208 billion, a more than 48 percent decrease, in 2021. For taxpayers with income between $1 and $50,000, unemployment compensation decreased from $262 billion in 2020 to $132 billion in 2021—a significant drop, but still nearly 13 times as large as unemployment compensation for the group in 2019.

Conclusion

The personal income tax is largely a tax on labor, primarily because our personal income is mostly derived from labor. Varied sources of capital income also play a role in American incomes, whether through tax-neutral retirement accounts or through taxable capital gains and dividends. Additionally, because of the unique structure of pass-through taxation, business income also accounts for an important source of personal income. As policymakers consider reforms to the individual income tax, understanding the types of income that make up the individual income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

can help them understand the tradeoffs of different changes to the tax system.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

Previous Versions

-

Sources of Personal Income, Tax Year 2020

10 min read

-

Sources of Personal Income, Tax Year 2019

10 min read

-

Sources of Personal Income, Tax Year 2018

10 min read

-

Sources of Personal Income, Tax Year 2017

9 min read

-

Sources of Personal Income, Tax Year 2016

9 min read

-

Sources of Personal Income, Tax Year 2015

9 min read

-

Sources of Personal Income, Tax Year 2013

12 min read

-

Sources of Personal Income, Tax Year 2012

12 min read