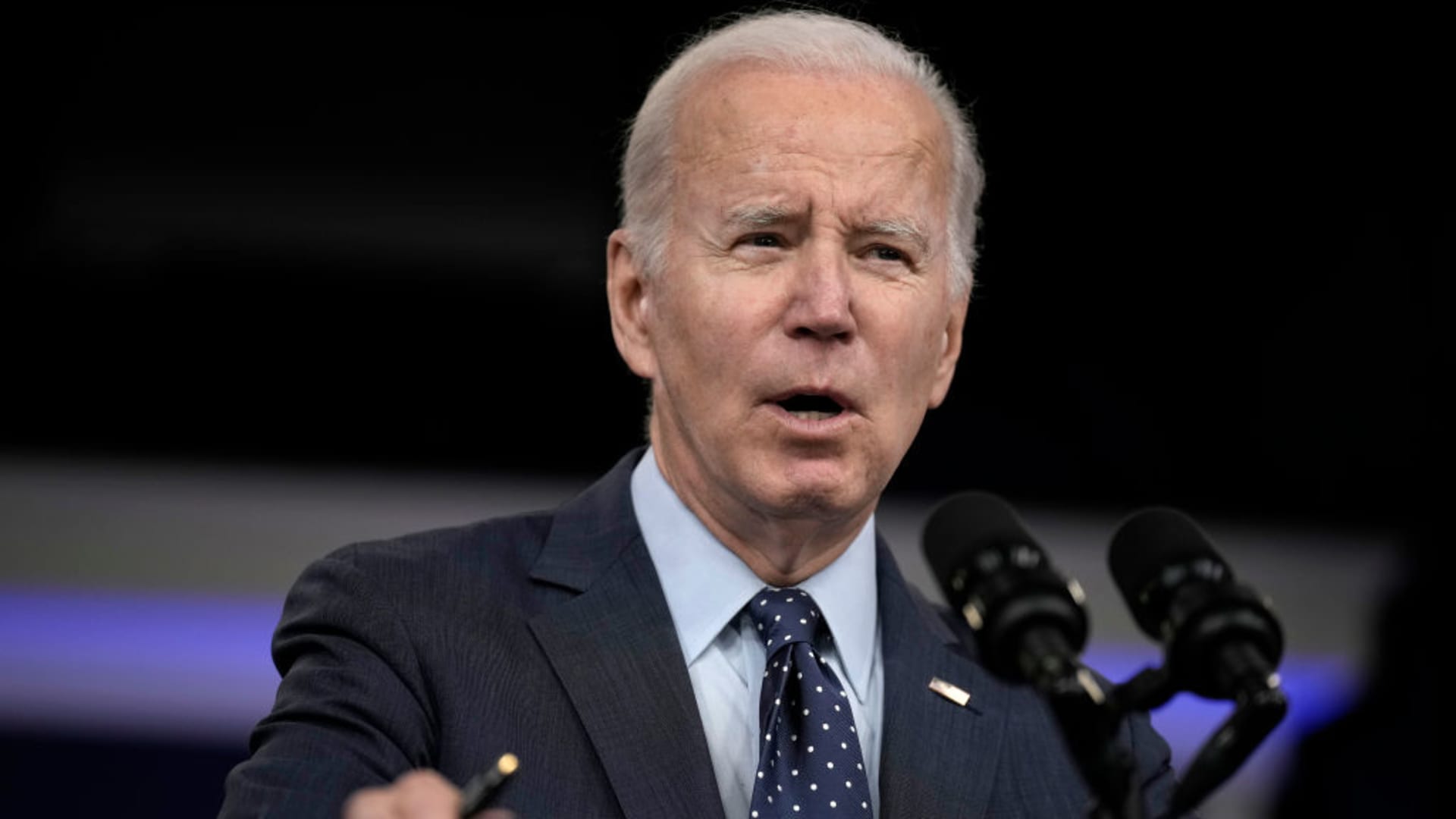

President Joe Biden is proposing higher taxes on wealthy Americans to help cover priorities like Medicare and Social Security in his 2024 budget.

The plan calls for a top marginal income tax rate of 39.6%, up from 37%, which was reduced as part of former President Donald Trump’s signature tax legislation. The repeal would apply to single filers making more than $400,000 and married couples with income exceeding $450,000 per year.

The budget also aims to tax capital gains at the same rate as regular income for those earning more than $1 million and close the so-called carried interest loophole, which allows wealthy investment fund managers to pay a lower tax rate than everyday workers.

Biden’s plan aims to reform the tax code to “reward work, not wealth,” White House Office of Management and Budget Director Shalanda Young told reporters on a call.

While the proposed tax increases aren’t likely to pass in the Republican-controlled House of Representatives, the plan highlights Biden’s priorities and will become a starting point for future negotiations.

Minimum 25% tax on wealth over $100 million

Biden also renewed his call for a minimum tax on the wealthiest Americans, which he revisited during the 2023 State of the Union address in February.

The plan includes a 25% minimum tax on Americans with wealth exceeding $100 million, and would “ensure that no billionaire pays a lower tax rate than a teacher or firefighter,” Young said.

Biden’s 2023 federal budget plan proposed a 20% levy on households with the same level of wealth, applying to “total income,” including regular earnings and so-called unrealized gains.

Senate Democrats pushed for a similar tax in October 2021 to help pay for their domestic spending agenda. However, both plans haven’t gained broad support within the Democratic Party.

Tax rates will increase in 2026

For 2023, the top marginal income tax rate of 37% kicks in at $578,126 for single filers and $693,751 for married couples, which is roughly 7% higher than in 2022 due to yearly inflation adjustments from the IRS.

Without additional changes by Congress, several provisions from the Tax Cuts and Jobs Act will sunset in 2026, bumping the top income tax rate back to 39.6%.

The change will also raise the other tax rates, which Biden mentioned in the budget, saying he plans to “work with Congress to address the 2025 expirations.”