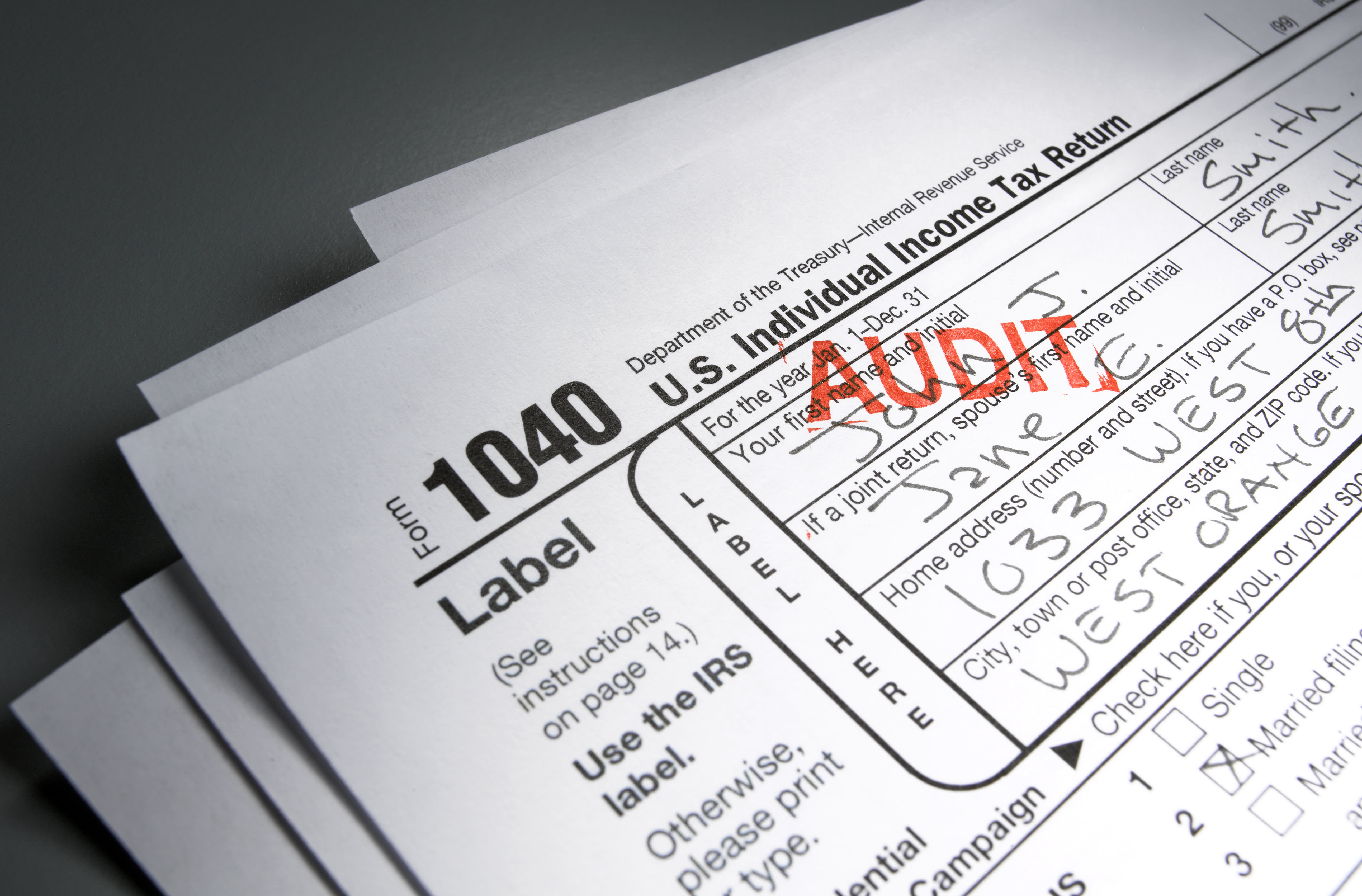

Tax season has kicked off, and the IRS has already warned filing mistakes may cause delays amid staffing shortages and a massive backlog.

While electronic filing offers the best chance for faster refunds, other moves may invite IRS scrutiny, according to tax experts.

The IRS closed 452,515 individual audits during its fiscal year 2020, about 0.29% of the roughly 157 million individual income tax returns filed, according to the agency.

“Some people play the audit lottery, meaning they’ll do whatever they want, and know that the chances of getting caught are slim,” said John Apisa, a CPA and partner at PKF O’Connor Davies, LLP. “That’s not a good philosophy to have, though.”

More from Personal Finance:

What happens if you don’t disclose crypto activity this tax season

Tax filing season kicks off. Here’s how to get a faster refund

How IRS transcripts can help this tax-filing season

While there’s typically a three-year statute of limitations for an IRS audit, with extensions in some cases, there’s no time limit on how long the agency can pursue fraud or non-filers.

One of the first cues may be trying to claim too many credits or deductions compared to your income, tax experts say.

The IRS uses software with a numeric score for each return, with higher scores more likely to spark an audit, explained certified financial planner David Silversmith, a CPA and senior manager of PKF O’Connor Davies, LLP.

The system estimates the appropriate range for each deduction or credit by income level, and if write-offs are outside that range, scores may increase, he said.

For example, $90,000 of earnings with $60,000 in charitable deductions will alarm the system, said Apisa.

You’re also likely to get flagged if the submitted tax forms don’t match your reported income, triggering an automated notice, said Preeti Shah, a certified financial planner and CPA at Enlight Financial in Hamilton, New Jersey.

For example, the IRS may receive your full-time wages on Form W-2, contract earnings on Form 1099-NEC or unemployment income on Form 1099-G. But you can avoid underreporting by double-checking forms with a free IRS transcript before filing.

Top red flags for an IRS audit

- Excessive write-offs compared to earnings

- Unreported income

- Refundable credits like the earned income tax credit

- Home office and auto deductions

- Rounded numbers

Write-off red flags

While advance child tax credit or stimulus payment errors are likely to get flagged this season, other write-offs tend to be perennial issues.

For example, the earned income tax credit, targeted at low- to middle-income families, is valuable because it’s refundable, meaning you can still get a refund with zero taxes due, Silversmith explained.

“If you claim the earned income tax credit while self-employed, that is a big red flag,” he said. “You need to have receipts for income, not just deductions.”

Round numbers are a tip-off that you’re just making these numbers up.Preeti ShahCFP and CPA at Enlight Financial

Self-employed filers need to be careful when claiming write-offs for a home office or a vehicle because those must be exclusively for business purposes, which may be more difficult to prove.

And you need to be precise when reporting credits and deductions.

“Round numbers are a tip-off that you’re just making these numbers up,” Shah said.

The burden of proof

“My best advice is that you’re only as good as your receipts,” said Apisa, because if the IRS wants evidence in two and a half years, you’ll need to have those readily available. And you’ll want to keep records for seven years.

You don’t have to be scared with the right paperwork to back up your returns, Shah added. If you receive notices and can provide proof, the IRS is generally “pretty reasonable.”